Once again the government has extended the deadline for filing an income tax return ITR for fiscal year 2020-21 by three months this time to December 31 2021 from the previous date of September 30 2021. Unlike the traditional income tax filing where you have to print out the income tax form and fill it in.

How To Calculate Income Tax In Excel

Select e-Borang from the e-Filing drop-down menu.

. Choose the tax year for which you will be filing an assessment. Click on e-Filing PIN Number Application on. You have to obtain PIN number from Tax Return Form.

Finally pay your income tax or claim a tax refund For those who do still have outstanding taxes to pay you can do so through many channels in Malaysia such as. E-Filing Pin number request. Headquarters of Inland Revenue Board Of Malaysia.

You must first go to httpsedaftarhasilgovmy and then click on the Daftar Individu button if you have never submitted your taxes before on the e-Filing income tax Malaysia 2021 platform. Following that you will be required to complete an online form and upload certain verification papers. Tax software providers are also accepting tax returns that have been filed in advance.

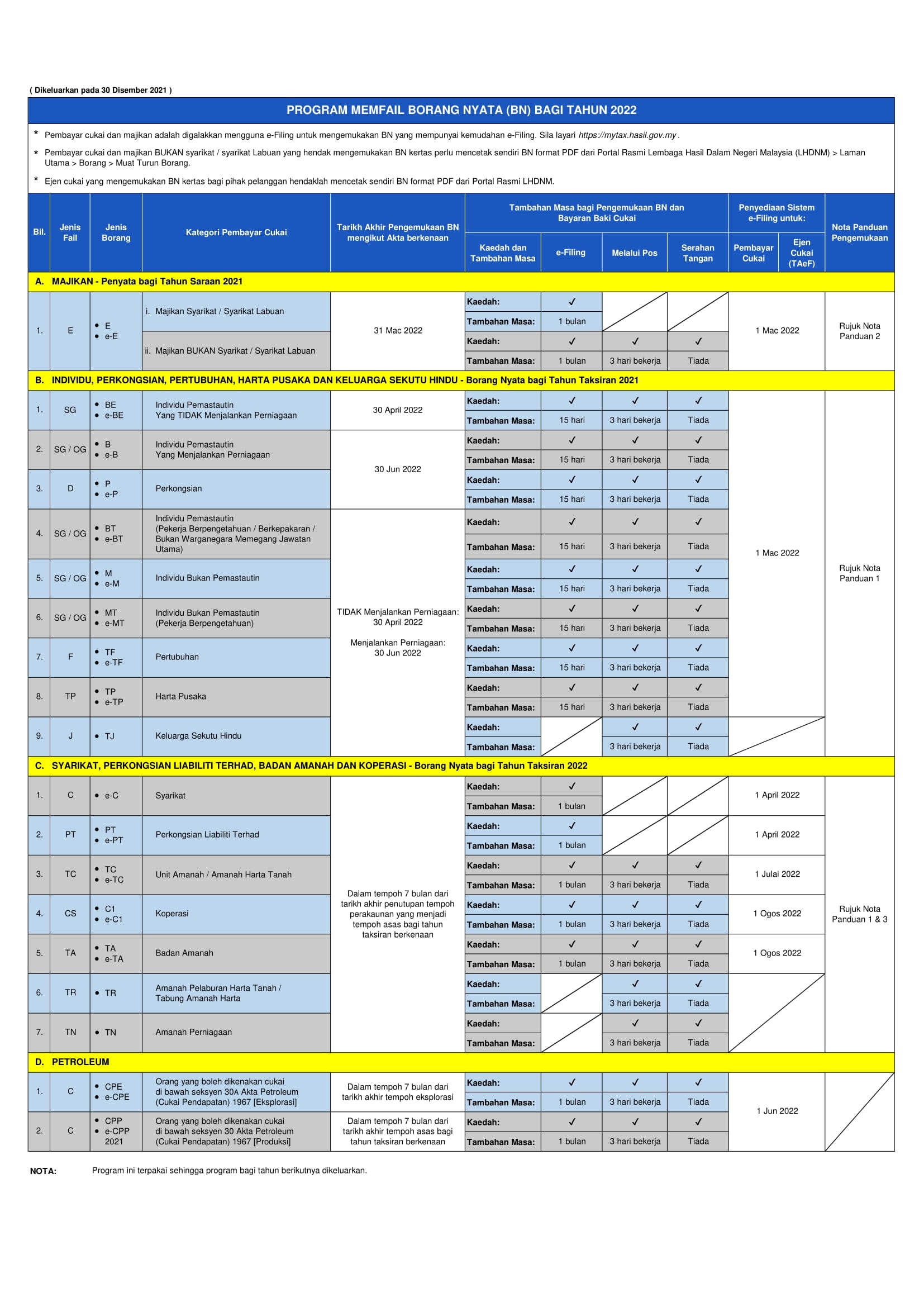

Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN. You from being charged tax increase court action and. 375 are allowed to submit their tax return forms.

Also stoppage from leaving Malaysia. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia. Online via Customer Feedback Forms at httpsmaklumbalaspelangganhasilgovmyMaklumBalasms-MY or.

30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Online submission via MyTax at httpsmytaxhasilgovmy. Return Forms can be submitted by two 2 methods.

When can you file income tax 2021. Following that you will be required to complete an online form and upload certain verification papers. IRBM official portal hasilgovmy Forms Download Forms Individual Year of Assessment.

For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020. Click on Permohonan or Application depending on your chosen language. Use e-Daftar and register as a taxpayer online.

The employer or the company in question will then remit the amount deducted from the salary to the Inland Revenue Board by no later than the 10 th day of the following month. Below are steps to activate MyTax account. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

The tax submission deadline under ITA is usually within 7 months after the end of accounting period. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year 1. 1 Self Assessment System SAS is based on the concept of Pay Self Assess and File.

Check the receiptsbank slips before leaving the payment counter. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for the year of assessment concerned. To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process onlineYoull need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand.

Commission fees statement prepared by company to agents dealers distributors. Go to httpedaftarhasilgovmy to apply for your Income Tax Reference Number. This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness.

Kindly refer guide notes explanatory notes which can be accessed from IRBM official portal before filling up. Manually to Tax Information Record Management Division LHDNM. Click Online Registration Form Borang Pendaftaran Online fill in your details and log in to your account.

MyTax - Gerbang Informasi Percukaian. 3 Copy of ICPassport. Paying income tax due accordingly may avoiding.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. PCB is deducted from the employees salary and it is the employers responsibility to ensure that the necessary amount is deducted accordingly. Log in to the LHDN Portal at httpsezhasilgovmyCI LHDN Portal login page.

1 Tax Reference Number. Visit your nearest IRB branch if you need help to complete your income tax return form or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas. Select e-Filing PIN Number Application.

How to submit your ITRF. For email application send all 4 required documents to pinhasilgovmy. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

You have to provide the following details and documents for PIN number application. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. As for your e-Filing PIN you can go to LHDNs website.

If the payment is over the bank counter or Pos Malaysia write down the name address telephone number income tax number year of assessment payment code 084 and instalment number 99 on the reverse side of the financial instrument. Annual income statement prepared by company to employees for tax submission purpose. Introduction Individual Income Tax.

Income Tax Breaks For 2020 The Star

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

How To Calculate Foreigner S Income Tax In China China Admissions

Important Dates For 2022 Tax Returns Leh Leo Radio News

How To Calculate Income Tax In Excel

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

How To Calculate Income Tax In Excel

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert Taxithere Helps To File Your Income Tax Return Filing Taxes Tax Services Online Taxes

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

How To Calculate Income Tax In Excel

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Income Tax Due Dates Income Tax Income Tax Due Date Income

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)